CBN urged to introduce ₦10,000 and ₦20,000 single notes

Economic experts are urging the Central Bank of Nigeria (CBN) to introduce ₦10,000 and ₦20,000 notes to reduce cash handling costs, improve transaction efficiency, and reflect the naira’s current real value.

CBN urged to introduce ₦10,000 and ₦20,000 single notes

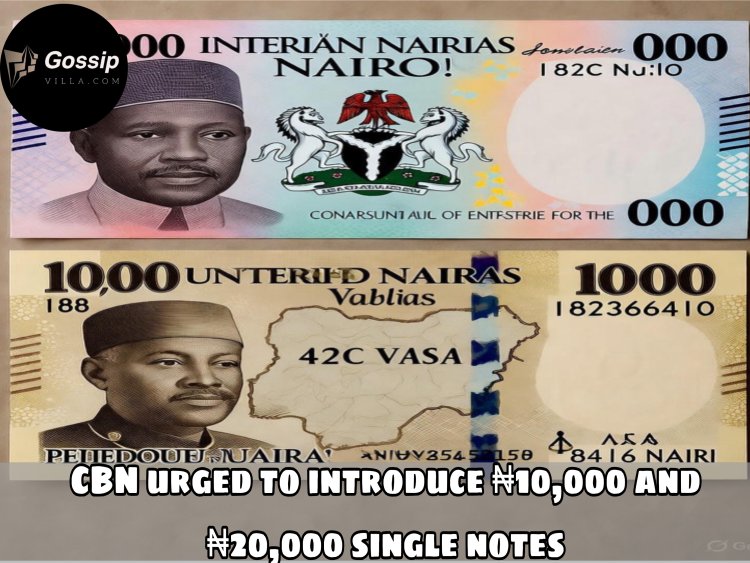

A new economic review by Quartus Economics has recommended that the Central Bank of Nigeria (CBN) should consider introducing higher-denomination banknotes specifically ₦10,000 and ₦20,000 notes or undertake a wider currency redenomination to restore the naira’s portability and cut the rising costs of cash transactions. The proposal argues that the country’s current highest note, the ₦1,000, has lost much of its real purchasing power and that higher-value notes would ease everyday transactions, especially in the informal sector.

Why analysts say higher denominations are needed

Quartus’s report, highlights a decades-long decline in the naira’s real value. The firm notes that when the ₦1,000 note was launched in 2005 it was worth the equivalent of roughly $7 at the official exchange rate; today the same note buys well under a dollar, making the current top denomination cumbersome for many cash transactions. The report frames the proposal as a practical measure to make cash more portable, reduce the volume of notes people must carry, and lower the costs the CBN incurs for printing, transporting and securing large volumes of low-value notes.

Practical benefits

Proponents say introducing higher-value notes would:

• Reduce the physical bulk of cash in circulation for the average shopper or market trader, making small daily transactions easier. • Lower logistical and security costs associated with printing and moving many low-value notes across the country.

• Align Nigeria’s currency structure with some other emerging economies that issue higher-value notes to match contemporary price levels.

The report stresses that the move would be a denominations-adjustment rather than a direct increase in money supply i.e., it is about convenience and currency design, not printing more money to finance spending.

Concerns and counterarguments

Critics often worry that issuing larger denomination notes could stoke inflation or make it easier to hoard cash and evade taxes. The Quartus report addresses these concerns head-on, arguing that denomination changes by themselves do not cause inflation price rises are driven by demand-pull and cost-push factors, not by the face values of banknotes. However, many economists caution that public communication, strong anti-counterfeiting design, and complementary fiscal and monetary policies would be essential to avoid unintended effects.

There are also practical questions the CBN would need to resolve: how to phase in new notes, how to withdraw or redesign existing ones, how to prevent counterfeiters from exploiting a change, and how to ensure the transition does not disrupt commerce — especially for cash-dependent sectors and rural communities.

Where the CBN stands

It’s important to note that the CBN has previously dismissed rumours about the immediate introduction of higher-denomination notes as false in the past; for example, in April 2025 the Bank publicly debunked circulating claims about the rollout of new ₦5,000 and ₦10,000 notes and urged the public to rely only on its official channels for currency announcements. Any actual change would therefore be formally announced by the CBN, accompanied by implementation guidance.

What to watch out for

If the CBN takes the Quartus recommendation seriously, watch for:

1. An official statement or consultation from the CBN about denomination policy.

2. Technical details on design, anti-counterfeiting measures, and the timetable for issuance and withdrawal.

3. Reactions from market participants banks, payment processors, traders and consumer groups about how any change would affect daily commerce.

Bottom line

Introducing ₦10,000 and ₦20,000 notes is presented by its proponents as a pragmatic response to decades of naira depreciation and the practical friction of conducting cash transactions with low-value denominations. While the idea addresses real convenience and cost issues, implementation would require careful planning, clear public communication, and supportive policy measures to avoid unintended economic or operational consequences. Any confirmed plan must come from an official CBN announcement; until then the proposal remains a policy recommendation under public debate.

Sources

What's Your Reaction?