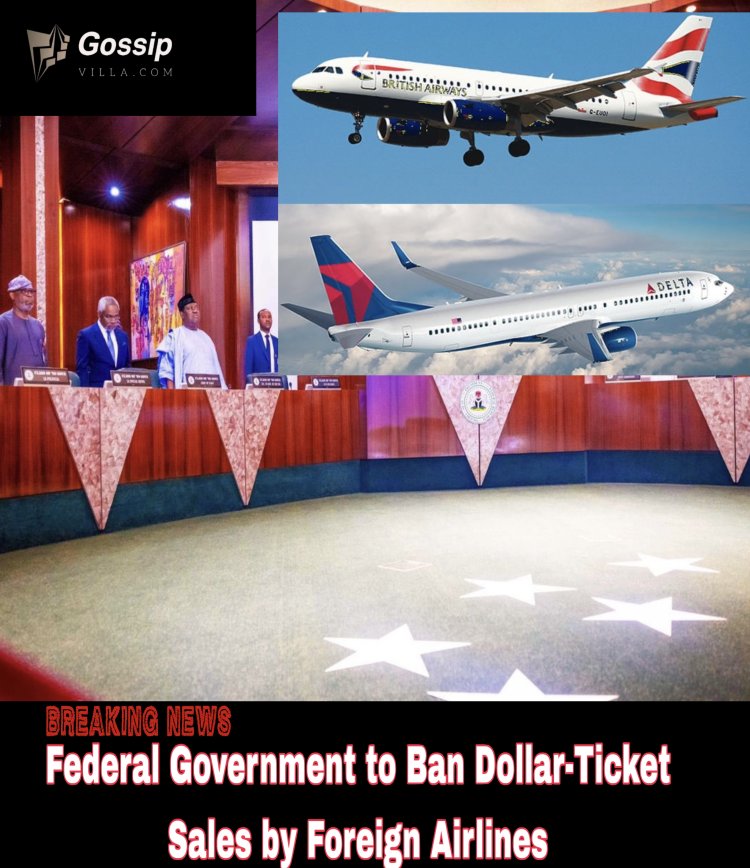

Federal Government to Ban Dollar-Ticket Sales by Foreign Airlines

The Federal Government of Nigeria is set to ban foreign airlines from selling tickets in dollars, as announced by NANTA President Yinka Folami. The policy aims to enforce naira exclusivity, empower local travel agencies, support Air Peace, and align with economic reforms stabilizing the currency.

Federal Government to Ban Dollar-Ticket Sales by Foreign Airlines

The Federal Government of Nigeria is set to terminate the practice of foreign airlines issuing air tickets in United States dollars within the country, according to Yinka Folami, President of the National Association of Nigerian Travel Agencies (NANTA). This forthcoming policy represents a significant intervention in the aviation sector, aimed at reinforcing the use of the naira as the sole legal tender for domestic transactions and aligning airline operations with national economic objectives. The announcement, made during a recent industry engagement, underscores a strategic effort to eliminate currency-related distortions that have long disadvantaged local stakeholders.

Historical Context: The Emergence of Dollar-Based Pricing in Nigerian Aviation

The adoption of dollar-denominated ticket sales by foreign carriers in Nigeria traces its origins to the severe foreign exchange constraints experienced in the early 2020s. Between 2021 and 2023, a combination of naira depreciation, limited forex liquidity, and Central Bank of Nigeria (CBN) capital controls resulted in billions of dollars in airline revenues being trapped and unrepatriated. In response, major international airlines including British Airways, Lufthansa, and Emirates progressively restricted ticket inventories and, in some instances, mandated dollar payments to mitigate exposure to currency risk.

This practice contravened existing Nigerian regulations, which stipulate that all transactions originating within the country must be conducted in naira. Nevertheless, enforcement was inconsistent during the period of acute economic distress. The International Air Transport Association (IATA) reported that by mid-2022, over $800 million in airline funds remained blocked, prompting threats of capacity reductions and route suspensions.

Current Economic Stabilization and Policy Realignment

Recent macroeconomic reforms have substantially altered the operating environment. Enhanced foreign exchange market transparency, unified exchange rate mechanisms, and improved liquidity have contributed to naira stabilization. Both the World Bank and the International Monetary Fund (IMF) have acknowledged these developments, noting a significant narrowing of the gap between official and parallel market rates.

In this context, the continued use of dollar pricing is increasingly viewed as an anachronism. Mr. Folami emphasized that “cross-border trading in foreign currency constitutes an economic offense,” as it exerts undue pressure on Nigeria’s foreign reserves and undermines monetary policy effectiveness. He further indicated that the Federal Government is actively formulating measures to enforce naira exclusivity in ticket sales, with implementation expected in the near term.

Impact on Local Travel Agencies and Market Dynamics

A principal beneficiary of the policy shift will be Nigeria’s network of IATA-accredited travel agencies. Currently, approximately 70% of NANTA members are excluded from direct contractual relationships with foreign airlines due to dollar-based inventory systems. This exclusion compels agents to procure tickets through intermediaries, incurring additional costs and reducing profitability.

Moreover, agencies frequently face Airline Debit Memos (ADMs) administrative penalties for alleged ticketing discrepancies that can reach $200,000 per entity. Mr. Folami attributes many such charges to technological incompatibilities rather than agent error, describing them as an inequitable burden on local operators.

The restoration of naira-denominated sales is expected to:

• Reintegrate excluded agencies into direct distribution channels;

• Reduce intermediary markups and ADM incidence;

• Enhance revenue retention within the domestic economy.

Implications for Air Travelers

For Nigerian consumers, the policy holds both opportunities and potential challenges. Dollar pricing has historically inflated effective fares when converted at parallel market rates, rendering international travel less affordable for the average citizen. A return to naira pricing, particularly amid currency appreciation, could yield more competitive and transparent fare structures.

However, airlines may initially adjust base fares to account for residual forex volatility. Long-term benefits are likely to accrue through heightened competition, particularly from indigenous carriers such as Air Peace, which has expanded services to high-demand routes including Lagos–London.

Strategic Support for Domestic Carriers

Mr. Folami framed patronage of Air Peace as a “patriotic imperative,” essential for sustaining Nigeria’s flagship airline and counterbalancing foreign dominance. The absence of a robust national carrier has historically amplified vulnerabilities in bilateral air service agreements and route economics. Strengthening local operators aligns with the government’s broader industrial policy of import substitution and economic self-reliance.

Regulatory and Enforcement Framework

While a precise implementation timeline remains undisclosed, the policy is anticipated to be enacted through a combination of:

1. Directives from the Nigerian Civil Aviation Authority (NCAA);

2. CBN guidelines reinforcing naira exclusivity;

3. Bilateral consultations to ensure compliance without precipitating route withdrawals.

Non-compliant carriers risk sanctions ranging from monetary penalties to operational restrictions. The resolution of outstanding trapped funds now largely cleared removes a key justification previously cited by airlines.

Broader Economic and Policy Implications

At the macroeconomic level, the prohibition constitutes a de-dollarization measure that conserves foreign exchange, supports naira demand, and signals policy consistency to international investors. It forms part of a continuum of reforms under President Bola Tinubu’s administration, emphasizing transparency, market-determined pricing, and inclusive growth.

Conclusion

The impending ban on dollar ticket sales by foreign airlines marks a decisive step toward regulatory coherence and economic sovereignty in Nigeria’s aviation sector. By mandating naira-denominated transactions, the Federal Government seeks to rectify structural imbalances, empower local enterprises, and enhance consumer welfare. Successful execution will require sustained collaboration among regulators, airlines, and travel intermediaries. As Nigeria’s aviation ecosystem evolves, this policy may serve as a model for other emerging markets grappling with similar currency and competition challenges.

Sources

What's Your Reaction?