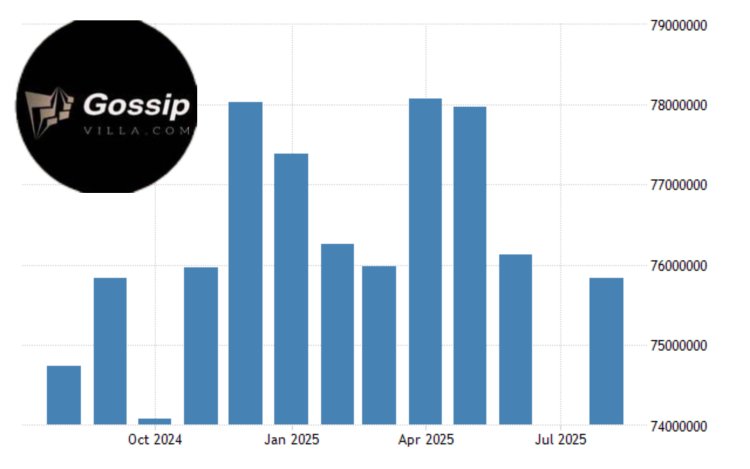

Nigeria’s Credit Market Shrinks: Net Domestic Credit Falls by 12.8% to ₦98.97 Trillion CBN Report

Nigeria’s financial sector experiences a sharp 12.8% drop in net domestic credit, signaling tighter lending conditions and potential economic slowdown, according to new data from the Central Bank of Nigeria (CBN).

Nigeria’s financial system is showing new signs of strain as the latest report from the Central Bank of Nigeria (CBN) reveals a 12.8% decline in net domestic credit, dropping from ₦113.5 trillion to ₦98.97 trillion as of August 2025.

The figure, which measures total credit extended to both the public and private sectors, highlights the tightening liquidity in Nigeria’s financial markets and the growing caution among banks in extending new loans.

According to the CBN’s Money and Credit Statistics, commercial banks have scaled back lending to government and corporate borrowers amid ongoing economic headwinds, rising non-performing loans, and weak consumer purchasing power.

Key Factors Behind the Decline

1. High Interest Rates:

With the Monetary Policy Rate (MPR) now at a record 27.25%, the cost of borrowing has significantly increased, discouraging both businesses and individuals from taking loans.

“The private sector’s access to credit has become more restrictive, particularly for SMEs that lack collateral or strong cash flow,” said one Lagos-based economist.

2. Inflation and Exchange Rate Pressures:

Nigeria’s inflation rate remains above 30%, while foreign exchange market instability has eroded bank margins. As a result, many lenders prefer to invest in short-term government securities instead of issuing fresh credit to the private sector.

3. Weak Business Confidence:

Business activity, particularly in manufacturing and trade, continues to suffer from high energy costs, supply chain disruptions, and limited access to foreign exchange for imports. This has dampened demand for new credit facilities.

The contraction in domestic credit is worrying for an economy still recovering from multiple shocks from fuel subsidy removal to exchange rate reforms. Credit is the lifeblood of business expansion, job creation, and consumer spending; therefore, reduced lending could slow down Nigeria’s economic recovery.

Economists warn that continued credit contraction may push more businesses to informal financing channels or force smaller enterprises to shut down.

“If the trend persists, it could worsen unemployment levels and weaken the overall GDP growth target for 2025,” said Dr. Aisha Yusuf, a financial analyst in Abuja.

In response, the Central Bank is reportedly reviewing its Credit Risk Management System to encourage more responsible lending while safeguarding financial stability.

There are also ongoing discussions about introducing targeted credit programs for agriculture, renewable energy, and manufacturing sectors to stimulate productive borrowing without worsening inflation.

For entrepreneurs and investors, the CBN’s data serves as a cautionary signal. Reduced credit growth means limited access to working capital, delayed project execution, and lower liquidity across industries.

However, analysts believe the current situation could stabilize by early 2026 if inflationary pressures ease and banks regain confidence in the market.

Investors are also optimistic that government fiscal reforms, infrastructure projects, and export-driven initiatives could help restore momentum in the credit system.

The drop in net domestic credit to ₦98.97 trillion underscores Nigeria’s ongoing struggle to balance growth with monetary stability. While the CBN aims to control inflation and strengthen the naira, the side effect is a slower-moving credit market one that could limit economic expansion if not quickly addressed.

Nigeria’s economic policymakers now face a delicate choice: maintain tight monetary policy to tame inflation, or ease credit conditions to spur growth.

Sources:

What's Your Reaction?